Why A Health Plan?

In today's fast paced lives that we live and in a race to excel in everything, we forget one of the most important asset we own i.e. our health. Due to various habits & changing lifestyles, health related concerns have just become increasingly alarming. We may not be to go back to slow down the pace of our lives but can definitely guard ourselves from its side effect. Here's when an efficient health cover comes handy so that any sudden illness doesn't derail our financial freedom.

Medical assistance comes with a price tag, such that people are forced to sell of their assets or rely on borrowers to meet the expenses. Such unforeseen events can be easily dealt with a strong health insurance plans. So guard your finances by opting for complete protection for you & your family by getting adequate health cover as per your requirements.

Why Personal Accident Insurance?

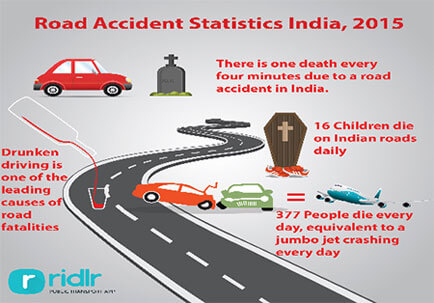

Life is uncertain & immeasurable. Accidents & uneventful incidents never ring a warning bell before they strike. Road mishaps, accidents have gone up tremendously & the victims along with their families suffer the consequences of the such unfortunate situation. Alarming statistics report about 1214 road related death that occur in India every year; this should be an eye opener on the perils an individual is exposed daily.

While minor accidents can cause temporary hurdles, major ones can lead to disability for life or even demise. With a view to providing certain relief, insurance companies have devised various policies that serve as true life savers when met with an unfortunate circumstance.

| Company Name | Plans for Individuals |

|---|---|

|

Advantages of Personal Accident Policy:

Give yourself a minute to think about what will happen to your dependents if you were disabled because of an accident? There will be no monthly income, no cash inflows but expenses will continue to rise. In such case, an accident insurance policy will help you bring these expenses under control.

Additional advantages are:

What does the policy cover?

Accidental Death

Accidental death coverage gives compensation on the policyholder's death caused by bodily injury resulting out of an accident. The nominee will receive entire sum assured offered by the insurer.

Permanent or Total Disability

If the accident causes permanent or total disability, then 100% of the sum insured is payable to the policyholder.

Accidental Dismemberment

If policyholder's body part has been dismembered or severed in the accident then the person can claim the sum insured.

Additional Benefits

Funeral expenses can be claimed in case of accidental death. Expenses incurred for transportation of policyholder's dead body from the accident spot to the residence place is covered.

Daily Hospitalization Expenses

Monetary relief offered to the patient on daily basis on hospitalization.

Burns

A certain amount of the policy sum is payable, when an accident results in hospitalization & the victim is being treated for burn injuries.

Bonuses

Some policies may offer bonuses to the dependent kids of the policyholder. This becomes helpful in case of the death of the policyholder or extension of treatment period.

Some Facts Of The Grim Picture Of Road Related Incidents:

Travel Insurance

Why Do You Need It?

Traveling has become an integral part of our modern society. We could be traveling for reasons like a business trip or much awaited vacation. But one cannot deny the fact that there are several things that could go wrong when one travels. Disruptions like cancellation of flights, loss of baggage, medical emergency- are some of the unforeseen events that could catch you off guard. So whether you are off to your favorite destination for a holiday or going on a business trip - an adequate & complete travel insurance is a must have.

Types of Travel Insurance

Various plans are available according to every individual's travel needs

1) Corporate Travel Insurance

Under this plan, employees of an organization can receive coverage for both domestic and international trips.

2) Domestic Travel Insurance

In this type, coverage is offered for death, medical emergencies, permanent disability, personal liability, delays, and lost/theft of checked-in luggage.

3) International Travel Insurance

It gives a comprehensive coverage for medical costs overseas, trip delays, loss of travel documents besides the regular coverage.

4) Senior Citizen Travel Insurance

This plan covers people in the age group 61-70 years. Besides providing general advantages, it also gives cashless hospitalization coverage and dental treatments.

5) Student Travel Insurance

This comprehensive cover is suitable for expenses incurred because of medical treatment, study interruptions and passport loss.

6) Individual Travel Insurance

Under individual travel plan, insured is covered against trip curtailment, trip cancellation and theft

7) Family Travel Insurance

It covers baggage loss, hospitalization expenses and other incidental costs. The claim disbursement is not difficult with less paperwork involved.

8) Multi Trip Insurance

This type of travel insurance is offered to frequent travelers so that they don’t have to apply for insurance every-time they travel.

9)Single Trip Insurance

As the name suggest, this type of cover is provided only for the duration of the trip. It also covers medical & non-medical emergencies along with baggage loss situations.

Key Features of Travel Insurance

1) Coverage offered for medical expenses.

2) Coverage for expenses related to trip delays

3) Coverage for loss of passport and luggage

4) For contingencies related to personal possession

Benefits of Travel Insurance

The basic worries of travellers include stolen baggage, lost passports, cancelled flights and trip delays. These mishaps can spoil perfectly planned vacations. Do not let such incidences ruin the entire journey.

Exclusions

1)Pre-existing conditions resulting to hospitalization

2)Damage or loss of keys

3)Trains or flights missed because of civil war/local protests

4)Luggage delay Expenses incurred because of civil unrest or local protests Customers should note that exclusions vary from one policy to policy.

FAQs Travel Insurance

What are the eligibility criteria for Travel Insurance?

From infants aged 6 months onwards can avail of travel insurance

Are there any medical examinations involved?

No, there is no medical examination required upto the age of 70 years.

Is travel Insurance mandatory?

Travel Insurance is not mandatory in India. However it is mandatory in UK and countries like Austria, Greece, Portugal, Spain, France, Germany, belgium, Luxembourg, Netherlands.

However for a safe and peaceful trip, it is recommended that you take a Travel insurance policy even if you are travelling to countries apart from these.

Is passport loss covered in the travel insurance policy?

Yes, passport loss is covered in the policy. It is covered under the benefit of loss of Baggage and Personal Documents. The assistance provider helps in contacting the consular authorities in case of the loss or theft of an Insured Personal's passport, and arranging for its replacement.

What does loss of checked in baggage cover ?

This covers the insured person for the amount spent as cost of replacement of articles if checked in baggage is lost or demaged. The insured must keep the bills of such expenses for reimbursement

How much cover do I need?

Depends on the duration and your age. Longer stay abroad needs higher cover. Higher age would also demand a higher cover.

What is Motor Insurance?

Motor insurance policy is mandatory for vehicle owners as per Indian Motor Vehicles Act 1988. This Plan is designed to give coverage for losses which insured might incur in case his vehicle gets stolen or damaged. The amount of motor insurance premium is decided based on the Insured Declared Value of a car. The premium will increase, if you raise the IDV limit and vice versa.

Why do I need to insure my vehicle?

Motor insurance is mandatory for all vehicles that ply on roads-like car, trucks, etc. The prime objective of this type of insurance is to provide complete protection & coverage on physical damage or loss from man-made & natural disasters. According to Indian Motor Act 1988, an motor insurance policy is mandatory for every automobile owner in the country. Hence, purchasing an motor insurance is not just a necessity, it is mandatory by law.

Key Features of Motor Insurance

1) Policy protection against loss or damage to the covered vehicle

2) Coverage against financial liability caused due to injury or death of a third party or damage to the property.

3) Personal Accident Coverage.

4) Motor Insurance protects you for the below mentioned damages, should they occur:-

| Accident | Fire | Lightening | Explosion |

|---|---|---|---|

| Self-Ignition | Transit by Rail, Road, Air & Elevator | Theft | Terrorism |

| Earthquake | Riot & Strikes and / or Malicious Acts | Flood, Cyclone | Inundation |

Types of Motor Insurance

1)Car Insurance

This insurance gives coverage against accidental damage or losses to the holder’s vehicle or third party. The amount of premium depends upon the make of the car, manufacturing year, value & state of registration.

2)Two Wheeler Insurance

This type of insurance is for scooters, bikes & features are similar to that of four-wheeler insurance.

3) Comprehensive Coverage

This type of coverage offers complete package policy wherein any damages to the vehicle will be covered up to the Insured Declared Value. Any third party property damage or third party injury/death can be covered. Policyholders feel less stressful as it gives end-to-end coverage.

4) Third Party Liability Coverage

Under the Motor Vehicles Act, third party liability coverage is legally mandatory. This type of motor insurance offers coverage against all legal liabilities to a third party caused when insured vehicle owner is at-fault. It insures injury/damage caused by policyholder to third person/property

5) Collision Coverage

It financially protects the policyholder against damage of insured’s own car. Collision coverage pays the policyholder for damage caused because collision which generally occurs due to an accident.

Add-On Riders

Add-on riders doesn't take the depreciation value of the parts & allows you to receive the entire claim amount. It is generally available for cars under five years & allows eligibility to claim full amount for replacing/changing any damaged parts of your vehicle.

Exclusions from Motor Insurance

1) General ageing, wear and tear

2) Damage by a person driving without a valid driving license

3) Mechanical or electrical breakdown, failure

4) Damage by a person driving under the influence of Liquor/Alcohol/Drugs

5) Depreciation, any consequential loss

6) Loss /Damage attributable to War /Mutiny /Nuclear risks

7) Damage to tyres and tubes are excluded unless the vehicle is damaged at the same time. In such circumstance, the liability of the company shall be limited to 50% of the cost which includes replacement Loss /Damage

Important points to remember in the event of an accident

These documents must always be in your vehicle:-

1) Copy of policy/cover note

2) Car Registration Copy (RC Book)

3) Driving License Copy

To Initiate The Claim Process

1) Get in touch with the contact centre & inquire for the network garage nearby. And in case, should you visit a non-networked garage, the bills will be settled after ascertaining the damages caused.

2) FIR may be asked by the Insurer based on the claim estimation.

Benefits of Group Mediclaim:

Benefits of Group Personal Accident:

Since it is a tailor made policy, we may alter any benefits before signing the proposal

Copyright © 2026 Design and developed by Fintso. All Rights Reserved